Services

First Fund offers cost-effective and flexible Fund Investor onboarding and Fund Administration services, setting us apart from other fund administration firms. Our founder, Ms. Celia Mok, has over 20 years of experience specialized in the financial industry and has been particularly focusing on global AML (Anti-Money Laundering) requirements, ensuring compliance and efficiency in fund operations.

Our Fund administration services refer to professional management and operational support provided to Funds (including investment funds, such as hedge funds, private equity funds, real estate funds, mutual funds, loan interest fund and project investment fund), Trusts, Trustees, and corporate structures. These services help stakeholders of the established vehicles and corporate structures (including fund investors, investment managers, trust owners, trustees) while ensuring compliance, accurate reporting, book-keeping & accounting, AML, investor services and efficient operations.

Key Functions of Fund Administration Services

✅ NAV Calculation & Accounting

- Net Asset Value (NAV) Calculation – Computes the value of fund assets and liabilities to determine NAV per share/unit.

- Bookkeeping Services – Bookkeeping involves the daily recording of financial transactions, ensuring that all fund activities are accurately documented.

Key Bookkeeping Services:

✔ Transaction Recording – Captures all fund transactions, including capital inflows, investments, and distributions.

✔ Ledger Maintenance – Keeps a general ledger with categorized financial data.

✔ Bank Reconciliation – Matches fund transactions with bank statements for accuracy.

✔ Expense Tracking – Monitors operational and fund-related expenses.

✔ Accounts Payable & Receivable Management – Tracks payments due from investors and payments owed to service providers.

- Financial Statement Preparation – Provides periodic financial reports, including balance sheets and income statements.

- Portfolio Reconciliation – Ensures accurate valuation and tracking of fund investments.

✅ Investor Services & Reporting

- Subscription & Redemption Processing – Manages investor transactions, including investor calls and redemptions.

- KYC/AML Compliance – Performs Know Your Customer (KYC) and Anti-Money Laundering (AML) checks on investors.

- Regular Investor Statements – Provides investors with periodic account statements and performance updates.

- Investor Communication – Issue email notification on behalf the Investment Manager(s)/Fund Director(s)

✅ Regulatory & Compliance Support

- Regulatory Filings – Assists with filings required by financial authorities (e.g., The Cayman Islands Monetary Authority, HKSFC, HK Companies Registry).

- Tax Reporting – Prepares tax reports, including FATCA, CRS, and other country-specific requirements.

- Audit Coordination – Works with external auditors to ensure smooth financial audits.

Who Uses First Fund Administration Services?

First Fund has extensive experience working with various types of investment funds. We have a deep understanding of market trends and regulatory requirements, allowing us to provide tailored solutions that meet the evolving needs of fund managers and investors.

Fund administration is essential for various investment entities, including:

- Hedge Funds – For complex trading strategies and investor reporting.

- Private Equity & Venture Capital Funds – To manage capital calls, distributions, and valuations.

- Mutual Funds & Unit Trusts – To comply with regulatory requirements and provide transparency.

- Real Estate Investment Funds (REITs) – For real estate asset valuation and investor distributions.

- Pre-IPO Fund – is an investment vehicle that provides capital to private companies before they go public through an Initial Public Offering (IPO). These funds allow investors to gain early access to high-growth companies, potentially benefiting from significant appreciation when the company lists on a stock exchange. First Fund monitors the target company progress with the Fund Manager and ensures compliance with financial regulations.

- Family Offices & Wealth Management Firms – To manage private portfolios efficiently.

- Project Investment Fund – A Project Investment Fund is a pool of capital dedicated to financing specific projects, such as infrastructure, construction, technology, renewable energy, music concert, anime intellectual property. Investors contribute funds with the expectation of returns based on project success. First Fund manages investment allocations, monitors project progress, and ensures compliance with financial regulations.

- Loan Interest Fund – A Loan Interest Fund is structured to provide capital for lending purposes, where returns are generated through interest payments on loans. Common in microfinance, peer-to-peer lending, and institutional lending structures. First Fund oversees loan disbursements, interest calculations, repayment tracking, and risk management.

Benefits of Using a Fund Administrator

✔️ Operational Efficiency

- Reduces administrative burden on fund managers.

- Ensures accurate and timely reporting.

✔️ Regulatory Compliance & Risk Mitigation

- Helps funds comply with international and local regulatory requirements.

- Reduces the risk of errors and fraud.

✔️ Enhanced Investor Confidence

- Professional third-party administration enhances credibility.

- Transparent reporting improves investor trust and retention.

✔️ Cost-Effectiveness

- Outsourcing fund administration is often more cost-effective than maintaining in-house teams.

How to choose the right Fund Administrator

When selecting a fund administrator, consider:

- Experience & Reputation – Track record in your specific fund type.

- Technology & Automation – Use of advanced systems for reporting and reconciliation.

- Regulatory Expertise – Understanding of compliance requirements in relevant jurisdictions.

- Global Reach & Local Presence – Ability to support international investors and multi-jurisdictional structures.

Fund administration services are crucial for efficient fund management, regulatory compliance, and investor transparency. By outsourcing these functions, fund managers can focus on investment strategies while ensuring accurate reporting and seamless operations.

For Fund Admin Service, please contact: 📧 info@ffund.hk

How to Establish a Cayman Islands Fund

The Cayman Islands is one of the world’s leading jurisdictions for investment funds due to its tax neutrality, investor-friendly regulations, and strong legal framework. Establishing a fund in the Cayman Islands involves several legal, regulatory, and operational steps.

Why Choose the Cayman Islands to set up a Fund?

✅ Tax Benefits – No corporate, income, or capital gains tax for funds.

✅ Regulatory Flexibility – Offers different fund structures tailored to investors’ needs.

✅ Strong Legal Framework – Based on English common law with a well-regulated financial system.

✅ Global Recognition – Used by hedge funds, private equity funds, and institutional investors worldwide.

Types of Investment Funds in the Cayman Islands

A. Regulated Funds (Registered with CIMA – Cayman Islands Monetary Authority)

Mutual Funds – Open-ended funds where investors can redeem shares.

- Registered Fund – Minimum investment of USD 100,000 per investor.

- Administered Fund – Requires a licensed Cayman administrator.

- Licensed Fund – Needs direct CIMA approval.

- Retail Fund – Fully regulated, suitable for public offerings.

Private Funds (Closed-Ended Funds) – Includes venture capital, private equity, and real estate funds.

- Governed by the Private Funds Act (2020).

- Must register with CIMA but has fewer regulatory requirements than mutual funds.

B. Unregulated Funds

- Single Investor or Family Office Funds – Not required to register with CIMA.

- Standalone Private Investment Vehicles – Used for specific asset holdings.

Steps to Establish a Cayman Islands Fund

Step 1: Choose the Fund Structure

The fund can be structured as:

📌 Exempted Company – Most common for hedge funds and open-ended structures.

📌 Limited Partnership (LP) – Typically used for private equity and venture capital funds.

📌 Unit Trust – Often used by Asian investors, similar to mutual funds.

📌 Segregated Portfolio Company (SPC) – Allows multiple sub-funds under one umbrella.

Step 2: Engage Legal & Fund Service Providers

- Cayman Legal Counsel – Drafts offering documents, memorandum & articles of association.

- Fund Administrator – Handles NAV calculations, investor reporting, and compliance.

- Auditor & Tax Advisor – Ensures financial transparency and regulatory filings.

- Prime Broker & Custodian – Manages trading and safekeeping of assets.

Step 3: Prepare and File Required Documents

- Offering Memorandum (OM) – Outlines fund strategy, risks, and investor terms.

- Subscription Agreement – Defines investor commitments and capital contributions.

- Fund Constitution – Includes Articles of Association, Partnership Agreement, or Trust Deed.

Step 4: Register with the Cayman Islands Monetary Authority (CIMA)

- Mutual Funds Registration (for open-ended funds with multiple investors).

- Private Funds Registration (for closed-ended funds that pool capital).

- Anti-Money Laundering (AML) Compliance – Appoint a Money Laundering Reporting Officer (MLRO).

Step 5: Open a Bank Account & Launch the Fund

- Set up a Cayman bank account or offshore banking solution.

- Start fundraising and onboard investors.

- Begin investment operations according to the fund’s strategy.

Ongoing Compliance & Reporting Requirements

✔ Annual CIMA Filing – Regulatory updates and financial statements.

✔ AML & KYC Compliance – Regular reporting to prevent money laundering.

✔ Audited Financial Statements – Mandatory for most regulated funds.

✔ Economic Substance Requirements – Applies to certain fund management entities.

Timeline

⏳ Timeline – Typically 4-8 weeks for fund registration and launch.

Why Work with First Fund?

Setting up a Cayman Islands fund requires expertise in legal structuring, regulatory compliance, and investor management. Working with fund administrators, legal advisors, and auditors ensures efficiency and regulatory adherence.

First Fund has well-established relationship with Cayman Islands law firms, ensuring seamless legal support for fund structuring and compliance. What sets First Fund apart is our in-depth expertise in drafting the Fund Private Placement Memorandum (PPM) and Fund Supplement. As a provider of fund administration and accounting services, we have a comprehensive understanding of fund operations, allowing us to craft precise and well-structured terms that minimize the risk of misinterpretation or disputes between the fund and its investors. Our extensive industry knowledge ensures that all provisions are clearly defined, aligned with regulatory requirements, and tailored to protect both the fund and its stakeholders.

For Cayman Islands Fund Setup service, please contact: 📧 info@ffund.hk to get quote.

What is Open-Ended Fund Company (“OFC”)

An OFC is an open-ended collective investment scheme which is structured in corporate form with limited liability and variable share capital. The main purpose of an OFC is to serve as an investment fund vehicle and manage investments for the benefit of its shareholders.

Being an investment vehicle, OFCs are NOT designed to engage in activities, such as commercial trade and business, undertaken by conventional companies which are incorporated under the Companies Ordinance (Cap. 622). OFCs are incorporated in or re-domiciled to Hong Kong under the Securities and Futures Ordinance (Cap. 571).

OFCs are governed by the following:

- Securities and Futures Ordinance (Cap. 571) Part IVA;

- Securities and Futures (Open-ended Fund Companies) Rules (Cap. 571AQ);

- Securities and Futures (Open-ended Fund Companies) (Fees) Regulation (Cap. 571AR);

- Code on Open-ended Fund Companies; and

- SFC Products Handbook

How to Set Up a Hong Kong Open-Ended Fund Company (OFC)

A Hong Kong Open-Ended Fund Company (OFC) is a corporate fund structure that allows for flexible capital inflows and redemptions, making it ideal for mutual funds, hedge funds, and private equity funds. Introduced under the Securities and Futures Ordinance (SFO), the OFC provides an alternative to traditional trust-based fund structures.

Please note that the HKOFC establishment application is not required to be submitted by a law firm or legal counsel. The application can be submitted directly by the fund’s appointed representatives or service providers.

Why Choose an OFC?

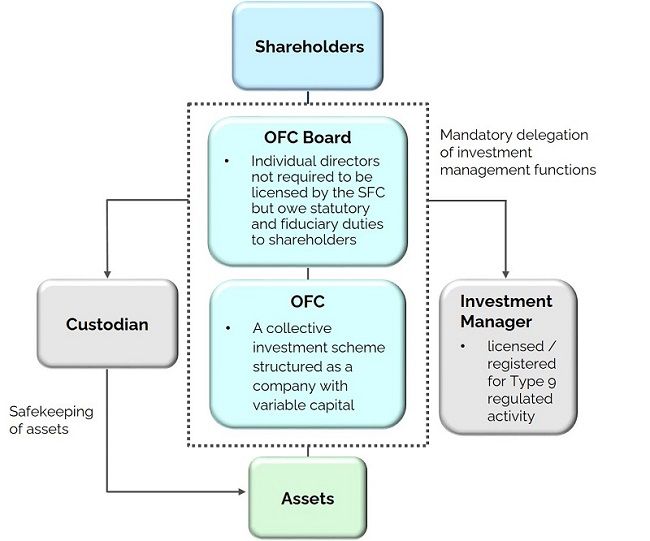

OFC Structure:

Key Parties in an HKOFC

- Investment Manager – Must be a SFC Type 9 (Asset Management) licensed corporation.

- Custodian –Must be a SFC Type 1 (Dealing in securities) licensed corporation with the condition “The licensee shall comply with all requirements applicable to it as a custodian in respect of an open-ended fund company, including the requirements set out in the Code on Open-ended Fund Companies and related guidance issued and revised by the Commission from time to time.” Or Type 13 – Providing Depositary Services for Relevant CISs)

- Board of Directors – Responsible for fund governance.

- Fund Administrator – Manages NAV calculations, investor services, and reporting.

- Auditor – Ensures financial transparency and compliance.

Steps to Set Up an OFC

Step 1: Choose the Fund Structure

- Standalone OFC – A single fund entity.

- Umbrella OFC – Can have multiple segregated sub-funds under one legal entity.

Step 2: Engage First Fund

- First Fund Consultant – Drafts offering documents and regulatory filings.

- First Fund Administrator – Handles accounting, investor reporting, and NAV calculations.

- Auditor & Tax Advisor – Ensures compliance with Hong Kong’s tax and financial regulations.

Step 3: Incorporate the OFC with the SFC Investment Products Department

- Complete the SFC Application forms and Companies Registry Application form

- File the Instrument of incorporation

- Draft Investment Management agreement

- Draft Offering document

- Submit an Application for Registration under the Securities and Futures Commission.

Step 4: Obtain SFC Authorization Approval (If required)

- Funds targeting retail investors must apply for SFC authorization that means Public OFC Fund.

- Private funds (institutional or professional investors) do not require SFC authorization approval but they must comply with AML/KYC regulations that means Private OFC Fund.

Step 5: Open a Bank Account & Launch Operations

- Set up a corporate bank account in Hong Kong.

- If required, set up a securities trading account in Hong Kong.

- Start capital raising and onboarding investors.

- Commence investment activities based on the fund’s strategy.

Compliance & Ongoing Requirements

Cost & Timeline

Final Step: SFC Grant Scheme for OFC Fund

The Securities and Futures Commission (SFC) Grant Scheme has been extended to further promote Hong Kong as a leading fund domicile. The extended scheme accepts applications from 10 May 2024 until 9 May 2027, providing financial support for fund registration, authorization, and re-domiciliation.

What is the SFC Grant Scheme?

The SFC Grant Scheme subsidizes part of the costs associated with setting up an Open-Ended Fund Company (HKOFC) or an SFC-authorized fund (including REITs). This initiative encourages fund managers to domicile their funds in Hong Kong instead of offshore jurisdictions.

Key Benefits:

Who is Eligible?

To qualify, the applicant must:

How Much Can You Claim?

- The grant covers 70% of eligible expenses, capped at HKD 150,000 per fund.

- Each fund manager can apply for up to one grant.

Eligible Expenses Include:

How to Apply for the SFC Grant Scheme?

Step 1: Register or Re-domicile the OFC with the Hong Kong Companies Registry

- Ensure the fund is newly established or re-domiciled and meets SFC requirements.

Step 2: Obtain SFC Authorization (If required)

- Retail funds must be authorized by the SFC.

- Private funds (for professional investors) do not require SFC approval but must comply with regulatory filings.

Step 3: Submit the Grant Application

- Applications must be submitted within three months of fund registration or authorization.

- Required documents include:

Fund Registration Certificate

Proof of Eligible Expenses (invoices, payment receipts)

Application Form

Why Work with First Fund?

At First Fund, we offer a one-stop service for setting up of Hong Kong Open-Ended Fund Companies (OFCs). Our expertise covers fund incorporation, HKOFC application submission, re-domiciliation, fund administration, and regulatory compliance. We ensure that your fund structure is optimized under SFC approval and help you maximize your SFC Grant Scheme reimbursement.

With our in-depth knowledge of fund structuring, administration, and accounting, we draft precise fund offering documents that protect both the fund and its investors, ensure full compliance with Hong Kong regulations. Whether you are launching a new fund or re-domiciling an existing one, First Fund provides seamless support at every stage.

Let us handle the complexities so you can focus on growing your fund.

please contact:

The Limited Partnership Fund Ordinance (Cap. 637) (“the Ordinance”), which stablishes a new limited partnership fund regime to enable private funds to be registered in the form of limited partnerships in Hong Kong, has commenced operation on 31 August 2020.

To foster the position of Hong Kong as a premier international asset and wealth management center, the limited partnership fund (“LPF”) regime is introduced to attract private investment funds (including private equity and venture capital funds) to set up and register in Hong Kong so as to facilitate the channeling of capital into corporates, including start-ups in the innovation and technology field in the Greater Bay Area.

An LPF is a fund that is structured in the form of a limited partnership which will be used for the purpose of managing investments for the benefit of its investors. A fund qualifying for registration under the LPF regime must be constituted by one general partner who has unlimited liability in respect of the debts and liabilities of the fund, and at least one limited partner with limited liability. A fund set up in the form of a limited partnership registered under the Limited Partnerships Ordinance (Cap. 37) may be registered as an LPF if it meets the eligibility requirements under the Ordinance.

The LPF regime is a registration scheme administered by the Companies Registry.

Hong Kong Limited Partnership Fund (LPF) Set up

The Hong Kong Limited Partnership Fund (LPF) regime provides a flexible and efficient fund structure for private equity, venture capital, real estate, and hedge funds. Designed to attract global fund managers, the LPF offers tax incentives, confidentiality, and streamlined compliance.

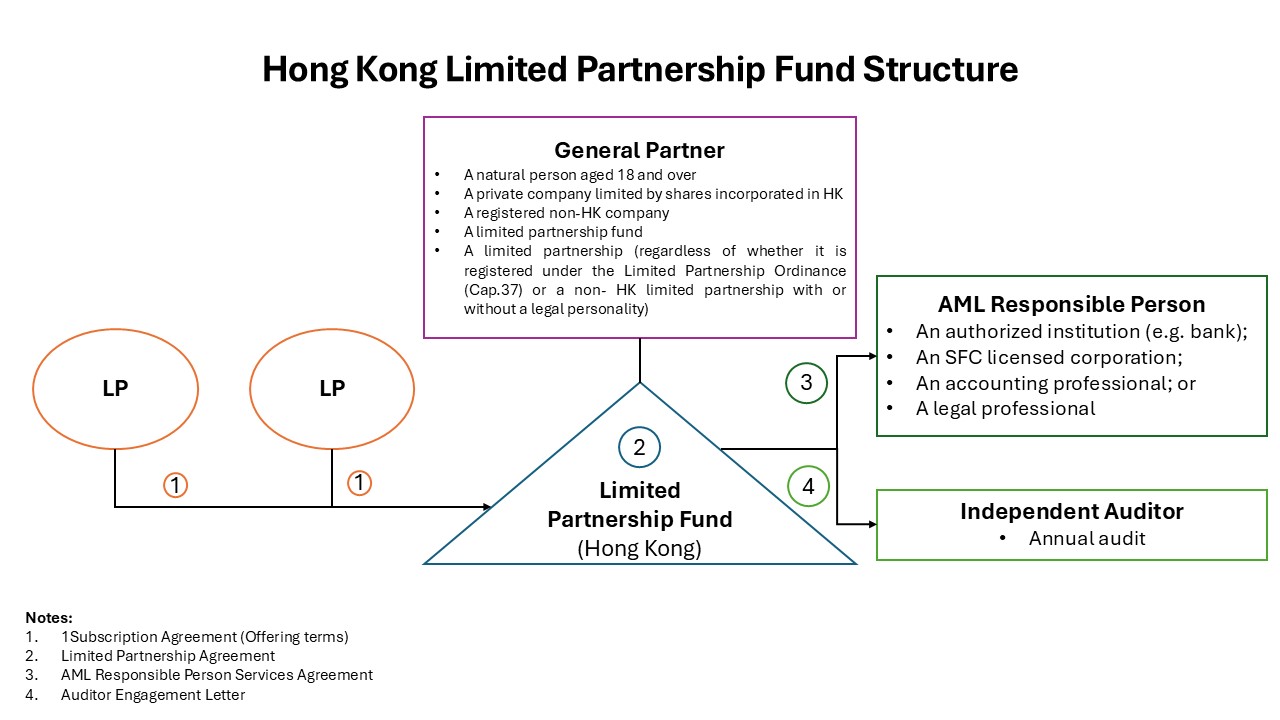

Limited Partnership Fund Structure:

Key Features of a Hong Kong LPF

✔ Flexible Structure – No minimum capital requirements; allows freedom in investment strategies.

✔ Legal Confidentiality – LPF details are not publicly disclosed, which ensures investor privacy.

✔ Tax Benefits – Exempt from profits tax if the fund qualifies under the Unified Fund Exemption Regime.

✔ No Investment Restrictions – Suitable for private equity, venture capital, real estate, and hedge funds.

✔ Fast Setup Process – Typically established within 1 month.

Who Can Set Up a Hong Kong LPF?

To establish an LPF, you need:

🔹 General Partner (GP) – Can be a Hong Kong company, registered non-HK company, or HK resident individual. The GP is responsible for the fund’s management and liabilities.

🔹 Limited Partners (LPs) – Investors in the fund, with liability limited to their capital contributions.

🔹 Investment Manager – to manage the fund’s assets and investment activities. Normally GP is A Hong Kong-registered company and A Hong Kong-registered branch of a foreign company

Do Investment Managers require a SFC License?

Not all Investment Managers require an SFC license. The requirement depends on the fund’s activities:

Scenario | SFC License Required? |

Managing private assets (e.g., private equity, venture capital, real estate funds, project investment fund) | ❌ Type 9 SFC License may NOT be required |

Managing public market securities, hedge funds, or discretionary accounts | ✅ Type 9 SFC License is required |

🔹 Responsible Person (RP) –to ensure compliance with Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) regulations.; must be a Hong Kong-SFC Licensed Corporation, an authorized institution, an accounting professional and a legal professional.

If the general partner meets one of the four conditions above, the general partner shall also be the responsible person.

Authorized institution (認可機構) has the meaning given by section 2(1) of the Banking Ordinance (Cap. 155). Licensed corporation (持牌法團) has the meaning given by section 1 of Part 1 of Schedule 1 to the Securities and Futures Ordinance (Cap. 571). Accounting professional (會計專業人士) and legal professional (法律專業人士) have the meanings given by section 1 of Part 2 of Schedule 1 to the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (Cap. 615).

🔹 Auditor – A Hong Kong auditor must be appointed for annual financial reporting.

🔹 Local Office Address – The LPF must have a registered office in Hong Kong.

Steps to Set Up a Hong Kong LPF

Step 1: Prepare Fund Documentation

📌 Limited Partnership Agreement (LPA) – Outlines fund structure, rights, and obligations.

📌 General Partner & Investor Agreements – Define investment terms and profit-sharing.

Step 2: Engage Fund Administrator

- A professional firm ensures compliance with Companies Registry (CR) .

Step 3: Submit LPF Registration to the Companies Registry

- The application must be filed by a Hong Kong law firm.

- Processing time: 14 to 30 business days

Step 4: Open a Corporate Bank Account

- A Corporate Bank Account is required for fund operations and investor transactions.

Why Set Up a LPF in Hong Kong?

✅ Strong Legal Framework – Governed by the Limited Partnership Fund Ordinance (LPFO).

✅ Reputable Financial Hub – Hong Kong is a leading Asia-Pacific fund management center.

✅ No Public Disclosure of Investors – Ensures confidentiality for LPs.

✅ Gateway to Mainland China – Hong Kong provides access to Greater China investment opportunities.

Why Work with First Fund?

At First Fund, we offer a cost-effective, one-stop solution for setting up Hong Kong Limited Partnership Funds (HKLPFs) in collaboration with our trusted law firm partners. Our deep expertise in fund structuring, offering terms, and agreements allows us to provide efficient and tailored solutions to meet your specific needs.

Our comprehensive services include:

✅ Fund Incorporation & HKLPF Registration

✅ Complete the Application Form

✅ Drafting Fund Documents & Limited Partnership Agreements

✅ Investor Onboarding & Compliance Support

✅ Fund Administration & Accounting Services

✅ AML/CFT Compliance & Regulatory Filing

With extensive experience in fund structuring, administration, and compliance, we ensure a seamless and efficient setup process, helping you launch and operate your HKLPF with confidence and cost-effectiveness.

📩 Contact us today to get started! 🚀

Trust Solutions & Consulting Services

Trust solutions provides a structured way to manage and protect assets, ensuring financial security, regulatory compliance, and smooth wealth transfer. These services cater individuals, families, businesses, and investment funds that look for legal and financial protection.

What Are Trust Solutions?

A trust is a legal entity where assets are held and managed by a trustee for the benefit of beneficiaries. Trust solutions helps manage wealth, minimize taxes, and ensure asset protection based on legal agreements.

Types of Trusts:

✔ Revocable Trust – Allows changes or termination during the grantor’s lifetime.

✔ Irrevocable Trust – Cannot be modified after creation, offering asset protection and tax benefits.

✔ Asset Protection Trust – Shields assets from creditors and legal claims.

✔ Charitable Trust – Supports philanthropic causes while providing tax benefits.

✔ Special Needs Trust – Ensures financial support for individuals with disabilities.

✔ Family Trust – Manages wealth for future generations.

✔ Corporate Trust – Used by businesses for security, bond issuance, and escrow services.

Trust Administration & Management Referral Services

A. Trust Setup & Structuring

- Legal Documentation – Drafts trust agreements, ensures compliance with jurisdictional laws.

- Trustee Appointment – Assigns professional trustees to manage assets.

- Asset Transfer & Titling – Transfers ownership of real estate, investments, and other assets into the trust.

B. Trust Accounting & Financial Management

- Investment Management – Professionally manages trust assets for growth and income.

- Tax Planning & Compliance – Ensures proper tax filings and benefits optimization.

- Financial Reporting – Provides regular statements on trust fund performance.

C. Estate Planning & Wealth Transfer

- Succession Planning – Ensures smooth inheritance and business continuity.

- Beneficiary Distributions – Manages payouts according to trust terms.

- Risk Protection & Probate Avoidance – Keeps assets secure and avoids lengthy legal processes.

Specialized Trust Solutions for Investment Funds

Trust services are also crucial for investment funds, hedge funds, and private equity firms:

📌 Escrow & Custodial Services – Safeguards investor funds before deployment.

📌 Pre-IPO & Private Equity Trusts – Holds equity stakes in private companies before public listing.

📌 Real Estate & REIT Trusts – Manages real estate assets for investors.

📌 Pension & Employee Benefit Trusts – Oversees retirement and employee fund management.

Benefits of Trust Solutions

✅ Asset Protection – Shields wealth from legal claims and creditors.

✅ Tax Efficiency – Reduces estate taxes and maximizes returns.

✅ Wealth Preservation – Ensures financial security for future generations.

✅ Privacy & Confidentiality – Keeps ownership and transactions private.

✅ Legal & Regulatory Compliance – Ensures adherence to financial laws.

Trust Cases Reference

Trusts: A Flexible Tool for Wealth Management and Succession Planning

A trust is a versatile tool for wealth management and inheritance, offering different levels of financial security and control based on an individual’s asset size and needs. Whether for families with modest assets or high-net-worth individuals with multiple properties, business shares, and investment portfolios, trusts can effectively facilitate wealth succession, asset protection, and risk isolation.

Who Can Benefit from a Trust and How?

General Asset Holders: Simplifying Wealth Transfer with Insurance and Wills

For individuals or families with a relatively small asset base, a trust may not be necessary. However, they can still ensure a smooth wealth transfer through the following means:

- Purchasing inheritance-focused insurance policies – Life insurance policies, for instance, can provide beneficiaries with a lump-sum payout upon the policyholder’s passing, preventing financial difficulties due to unexpected events.

- Drafting a will – A legally prepared will clearly outlines asset distribution, reducing potential inheritance disputes among family members.

While these methods are cost-effective and easy to implement, they have drawbacks. Legal procedures may cause delays in asset transfers, and wills may be subject to legal challenges or disputes regarding their validity.

High-Net-Worth Individuals and Those with Complex Asset Portfolios: Establishing a Trust for Long-Term Stability

For individuals with significant assets, such as multiple properties, financial investments, or business shares, establishing a trust fund is often the preferred solution. This ensures that wealth is managed and distributed according to the grantor’s wishes, preventing reckless spending by heirs and mitigating financial risks.

Benefits of This Approach:

✔️ Prevents Asset Fragmentation and Wealth Erosion – Directly dividing assets among heirs can lead to poor financial decisions or investment mismanagement, causing rapid wealth depletion. A trust allows assets to be centrally managed, ensuring long-term stability.

✔️ Provides Beneficiaries with a Regular Income – For instance, his son, Francis Choi, does not own any properties outright. Instead, he receives a monthly allowance from the family trust while residing in a mansion owned by the trust. This ensures financial security without the risk of reckless spending.

✔️ Manages Tax and Legal Risks – Trusts help minimize estate tax liabilities and provide legal protection, ensuring a smooth, tax-efficient transfer of wealth to future generations.

Using Trusts to Protect Assets in Divorce Settlements

Beyond wealth succession and asset management, trusts can also serve as a safeguard against the financial risks of divorce.

- Pre-emptively Establishing a Trust to Shield Personal Assets – Individuals anticipating future marital risks can transfer assets into a trust before or during the marriage. Since these assets are no longer owned personally but by the trust, they are not considered marital property in the event of a divorce, preventing asset division.

- Protecting Family Wealth – If a family owns a business or substantial assets, a trust ensures that these assets remain within the family, unaffected by marital disputes. Many wealthy families require members to hold assets through a trust to prevent financial loss due to divorce.

- Maintaining Control of Assets – Even if a marriage ends, a trust ensures that assets are managed and distributed according to the grantor’s wishes, unaffected by emotional or legal disputes.

However, trusts must be established before any divorce proceedings begin. If assets are transferred after a divorce has been initiated, courts may invalidate the transfer, considering it an attempt to fraudulently conceal assets. Advance planning is crucial.

Key Advantages of Trusts

✔️ Asset Protection – Assets held in a trust are separate from personal ownership, shielding them from bankruptcy, debt claims, or divorce settlements.

✔️ Wealth Succession – Trusts ensure that wealth is distributed according to the grantor’s wishes. They can also impose conditions, such as monthly allowances, to prevent irresponsible spending.

✔️ Tax and Legal Risk Management – Trusts may help reduce estate tax burdens and offer legal protections for beneficiaries.

✔️ Avoiding Family Disputes – Since professional trustees manage the assets, trust structures reduce inheritance conflicts among family members.

✔️ Marital Asset Protection – Trusts prevent personal assets from being divided in divorce settlements, ensuring wealth security.

Conclusion

The structure of a trust can be tailored to fit an individual’s financial situation and needs. For ordinary families, insurance policies and wills can provide basic wealth transfer solutions. However, for high-net-worth individuals with substantial assets, properties, or family businesses, a trust fund is a far more secured and effective wealth management strategy.

Additionally, trusts can act as a protective tool against marital risks to ensure personal and family wealth remains intact despite relationship changes.

Whether for wealth succession, asset protection, or marital financial security, a trust is a valuable long-term financial planning tool. To ensure the most effective and legally sound trust structure, it is essential to consult professional legal and financial advisors who can help design a solution that aligns with your financial goals.